We usually use mutual funds in some capacity when developing our clients’ portfolios and have found that most people have heard of them but aren’t exactly sure what they are. Some folks are afraid of them. Other folks are gung-ho to use only mutual funds because they learned that they should from a radio show or podcast. Mutual Funds are one of the most popular investment products out there today, they are not all created equal, and it’s important that you understand them.

First, start by thinking of a mutual fund as its own company. This company wants to invest money, so a bunch of people band together to “mutually” fund the company so it can. The company has a lot more money to invest than it would have had if just one investor contributed, so this mutually-funded investment company can now buy and hold more diverse positions in stocks and/or bonds and other investment products. The individuals that have funded the mutual fund then hold shares of the mutual fund itself, instead of holding what could amount to tiny fractions of stocks and bonds. Mutual Fund = mutually funded.

This is the main advantage of a mutual fund: investors can achieve greater levels of diversification than they could on their own. Another advantage of a mutual fund is that it is headed up by a fund manager, which sometimes is just one person but is usually a team of professional investors that analyze the market and landscape of the securities world to decide what investments to hold in order to achieve the funds objective. Because a mutual fund is going to have significant amounts of assets, it can also result in lower fees and trading costs than if an individual does it on their own. And, just like stocks, a mutual fund company stands ready to redeem your shares when you want so it’s a relatively liquid investment.

Some of the disadvantages of mutual funds are tied directly to the advantages. Having a professional fund manager costs money, and so does operating a large fund company; so fees will come out of the investment in the fund. Some funds have much higher fees than others, so it’s important to know what the fees of one fund compared to a similar fund may be. Sometimes mutual funds get so popular that a whole bunch of people start buying shares and the fund becomes bloated and it’s harder to find good performing investments on such a large scale. One last disadvantage to mutual funds is the turnover. If the mutual fund is not sheltered by a tax-deferred overcoat like an IRA or 401(k), whenever the fund manager makes changes to the allocation it could trigger capital gains; so if taxes are a concern make sure to mitigate this risk.

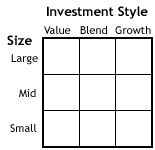

Mutual Funds come in all sorts of flavors and wrappers. There are bond mutual funds or just “bond funds” that are mutually funded and invest in bonds. There are international funds that invest in international companies securities. There are growth funds that invest in companies that are growing. There are value funds that invest in companies that are undervalued. A stylebox is a handy tool to help find out what kind of investments are in a certain equity fund:

Along the left-hand side the market-capitalization of the fund is listed. Market-Cap is a way to measure the size of the companies the fund is invested in. Value, Blend, and Growth refer to where on the scale the fund leans regarding what types of companies it’s invested in. There are a plethora of other fund styles to choose from that are more specialized. There are sector funds that stick to one sector of the economy (tech, industrials, auto, etc.) and there are socially-responsible funds (for green people) and there are morally-responsible funds (for guilty people).

Mutual Funds are advantageous to most investors. We believe that investing in mutual funds is usually preferable to investing in single stock and bond positions for portfolios that are under 1 million dollars.