You wake up feeling refreshed and energized, ready to take on your day. Things have been going pretty well after all. You just paid off that nagging credit card balance from two Christmases ago. You’ve got your emergency fund set up, and you are ready to slay your next financial giant. You grab your coffee and head out the door. You jump in your soon to be paid off ride and jet off to work. Feelings of pride and accomplishment well up inside. As it turns out, you are pretty good at personal finance.

The drone of local weather and traffic through your radio is suddenly interrupted by a loud THUMP…flap flap flap. And just like that, it hits you. You feel the steering wheel pulling you off to the side of the road. And then… that sinking feeling. How much is this going to cost me? New tires were not in the plan. How could this happen? So much for all my hard work and progress! These are the types of things that tend to wreck budgets and exhaust emergency funds. The credit card comes out and the vicious cycle starts all over again. It’s easy to get discouraged and throw in the towel.

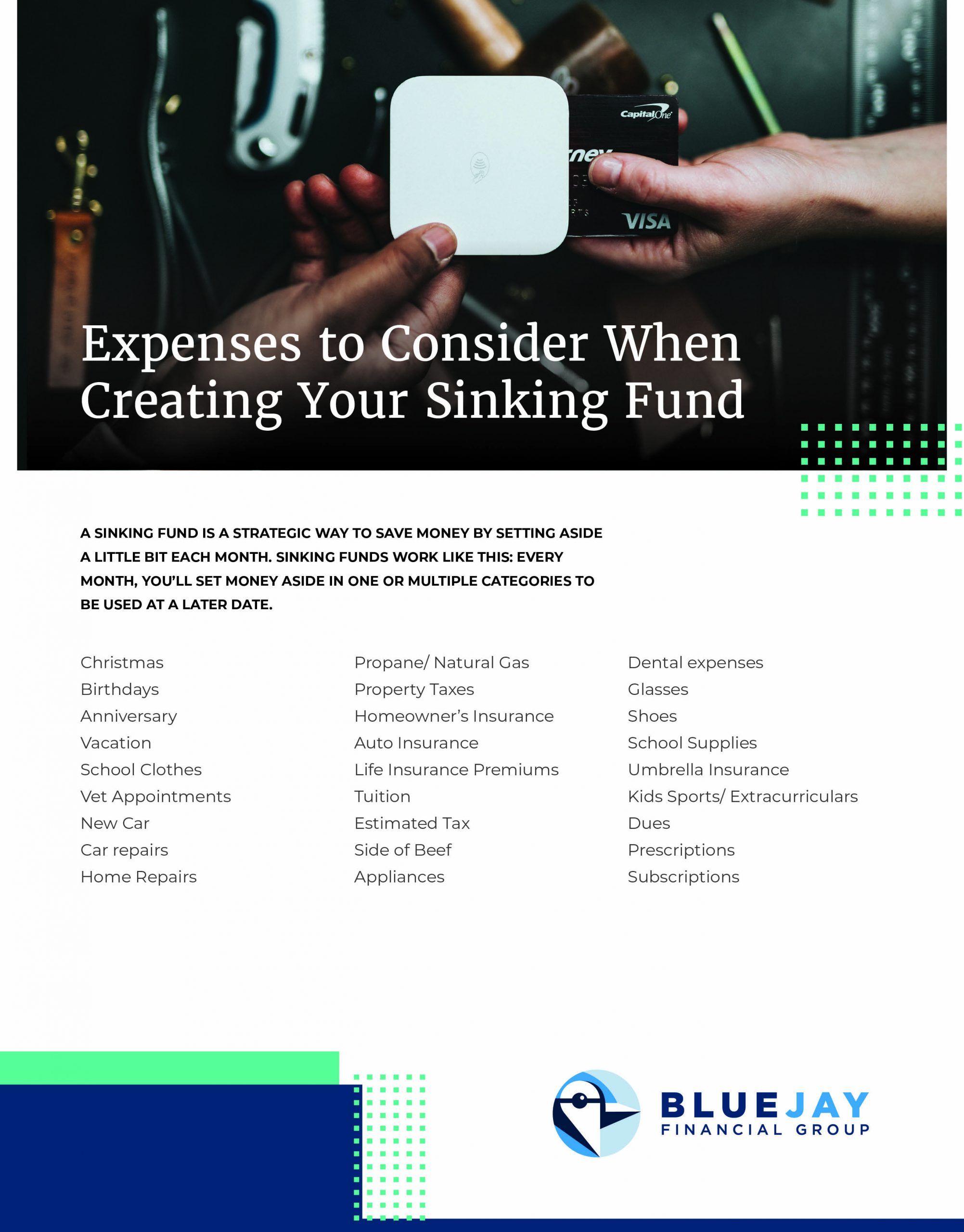

The remedy for that sinking feeling may be a sinking fund. A sinking fund is a way to save money by setting aside a little at a time for a larger purchase or expense that is sure to come up, in the case above, new tires. If you have 60,000-mile tires and you drive 20,000 miles a year, it is reasonable to expect that you will need new tires in 3 years. Rather than be surprised by a $720 expense, you could set aside $20 each month for tires ($720/ 36 months = $20).

Another practical example is your mortgage escrow account. Property taxes and insurance are due the same time every year. You fund your escrow every month and when the taxes are due the money is there to disburse. Think of other predictable expenses that seemingly pop up to derail you. The idea is to plan for them and continue making progress on your other goals.